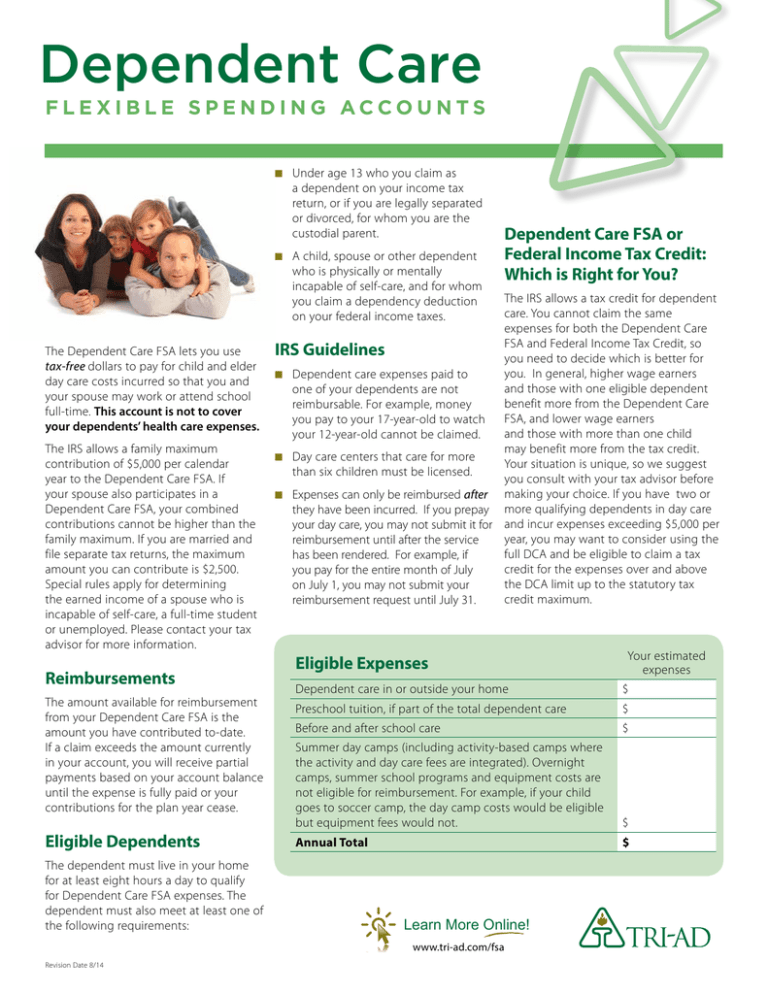

dependent care fsa eligible expenses

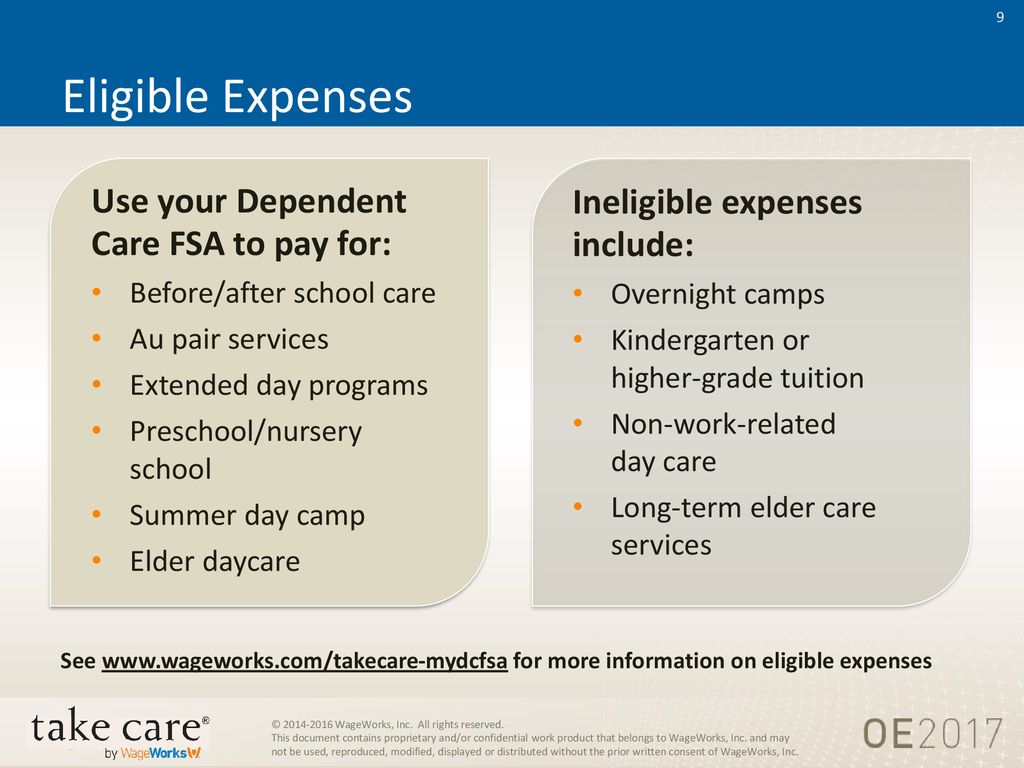

Dependent Care FSA Eligible Expenses Care for your child who is under age 13 Before and after school care Babysitting and nanny expenses Daycare nursery. Eligible Child Care Expenses Keep Your Receipts.

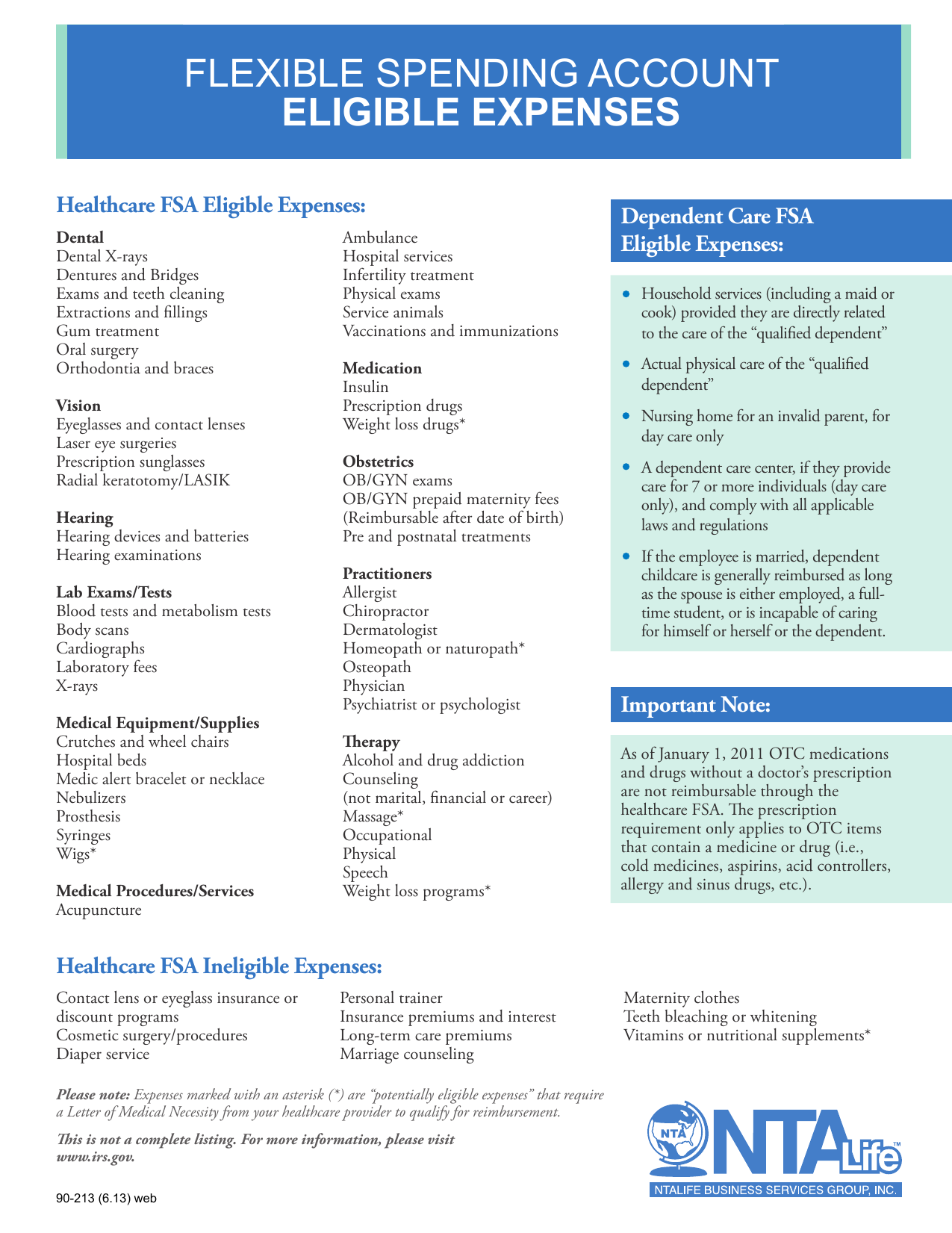

When the expense has both medical and cosmetic purposes eg Retin-A which can be used to treat both acne and wrinkles a note from a medical practitioner recommending the item to treat a specific medical condition is required.

. Dependent Care Flexible Spending Account eligible expenses are more expansive than many parents realize and narrower than others hope. Limited Expense Health Care FSA. Services that are eligible.

If you are married and file separate tax returns each spouse may contribute 2500. You can use your FSA funds to pay for a variety of expenses for you your spouse and your dependents. Below are the basic rules followed by our interpretation as they relate to standard service providers.

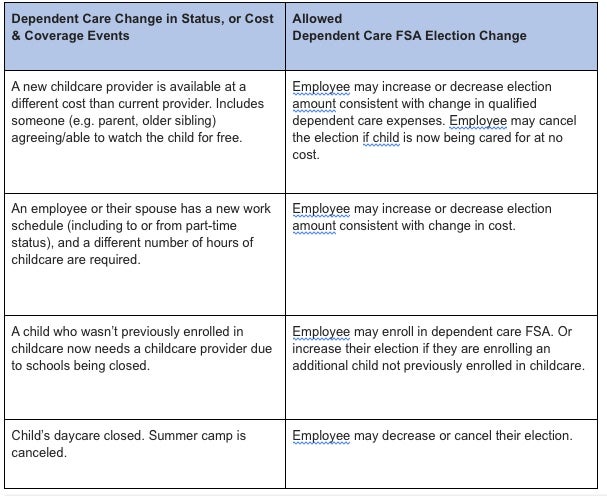

The expenses must enable you and your spouse to work or look for a new job. While this list shows the eligibility of some of the most common dependent care expenses its not meant to be comprehensive. Dependent care FSA-eligible expenses include.

If youre enrolled in a dependent care flexible spending account DCFSA you can use your pre-tax funds to cover expenses for your childdependent under the age of 13 as well as adult dependents based on dependents you claim on your tax returns for dependent care while you or your spouse work or look for work. While this list identifies the eligibility of some of the most common dependent care expenses its not meant to be comprehensive. Daycare nursery school or preschool.

The cost of routine skin care face creams etc does not qualify. Employees can only be reimbursed through their DCFSA for certain qualified expenses. You can use your Dependent Care FSA to pay for a huge variety of child and elder care services.

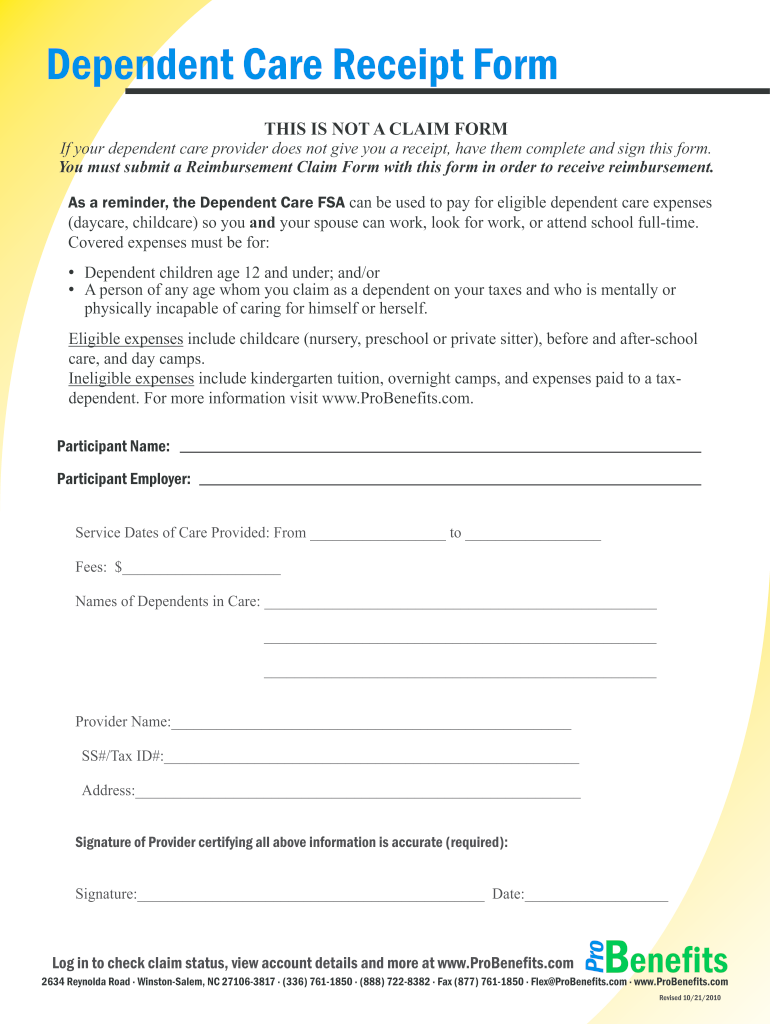

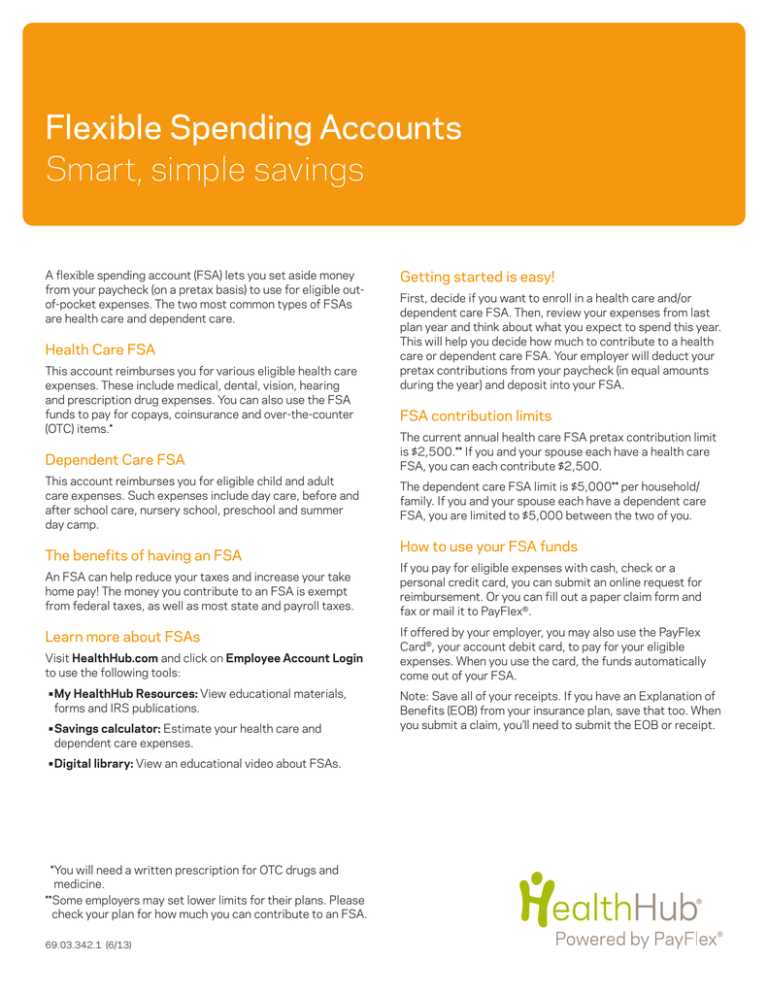

The Dependent Care FSA allows certain out-of-pocket daycare costs to be paid on a pre-tax basis. Its important to keep receipts and other supporting documentation related to your WageWorks Dependent Care FSA expenses and reimbursement requests. Since FSA contributions are pre-tax you save money by not paying taxes on your contributions.

For 2021 the credit figured on Form 2441 Child and Dependent Care Expenses line 9a is unavailable for any taxpayer with adjusted gross income over 438000. Not all babysitting services are eligible. To find out which expenses are covered by FSAFEDS select the account type you have from the list below.

16 rows Various Eligible Expenses. The IRS determines which expenses can be reimbursed by an FSA. Dependent Care FSA Eligible Expenses.

Above 125000 the 50 credit percentage goes down as income rises. 16 rows Various Eligible Expenses. The IRS determines which expenses are eligible for reimbursement.

However you may still be eligible to claim a credit on Form 2441 line 9b for 2020 expenses paid in 2021. You can use your Dependent Care FSA DCFSA to pay for a wide variety of child and adult care services. Adult day care facilities.

The IRS requires appropriate documentation for all Dependent Care FSA reimbursements. Typically the most that you can contribute to a dependent care FSA is 5000. The IRS determines which expenses can be reimbursed by an FSA.

These are care services that allow them to go to work. Keep in mind this amount may be less based on earned income and tax filing status. If your spouse also has access to a Dependent Care FSA your total combined contribution may not exceed 5000.

You can use your Dependent Care FSA DCFSA to pay for. What is a Dependent Care FSA. Employers can choose whether to adopt the increase or not.

Dependent Care Flexible Spending Accounts FSAs also known as Dependent Care Assistance Programs DCAP allow you to use pre-tax dollars to pay for qualified dependent day care expenses to enable you to work. The IRS determines which expenses are eligible for reimbursement. Services must be provided while the employee and their spouse are at work looking for work or attending classes as a full-time student.

Dependent Care FSA Eligible Expenses. This means that if you and your spouse each have a dependent care FSA youre limited to 5000 between you. Summer camps for dependent children under age 13.

The IRS determines which expenses can be reimbursed by an FSA. You decide how much to contribute to your Dependent Care FSAbetween 26 and 5000 per plan year August 1July 31. Dependent Care FSA Eligible Expenses.

Expenses that occur before the beginning of the FSA plan year are not eligible. You can use your Health Care FSA HC FSA funds to pay for a wide variety of health care products and services for you your spouse and your dependents. Dependent Care FSA Eligible Expenses.

This is per household per year. The IRS determines which expenses are eligible for reimbursement. You can use your Dependent Care FSA to pay for a huge variety of child and elder care services.

While this list identifies the eligibility of some of the most common dependent care expenses its not meant to be comprehensive. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could contribute 5250 up from 2500. Before and after school care Babysitting and nanny expenses Daycare nursery school and preschool Summer day camp Care for your spouse or a.

Examples of eligible expenses include.

Dependent Care Fsa Flexible Spending Account Ppt Download

Dependent Care Flexible Spending Accounts Flex Made Easy

Fsa Open Enrollment 24hourflex

Why You Should Consider A Dependent Care Fsa

What Is A Dependent Care Fsa Wex Inc

Dependent Care Fsa Flexible Spending Account Ppt Download

How To File A Dependent Care Fsa Claim 24hourflex

Health Care And Dependent Care Fsas Infographic Optum Financial

Health Care And Dependent Care Fsas Infographic Otosection

Your Flexible Spending Account Fsa Guide

Message For 2020 Dependent Care Fsa Participants Office Of Faculty Staff Benefits Georgetown University

Probenefits Dependent Care Receipt Form 2010 2022 Fill And Sign Printable Template Online Us Legal Forms

Flexible Spending Accounts Smart Simple Savings Getting Started Is Easy